Company credit reports purchased with us are removed from your account 12 months after the purchase date. But why?

Watch the video to find out.

By Mathew Aitken at MadeSimple – Find Mathew on Google+

Company credit reports purchased with us are removed from your account 12 months after the purchase date. But why?

Watch the video to find out.

By Mathew Aitken at MadeSimple – Find Mathew on Google+

How does your business look?

Company credit reports can be invaluable when it comes to carrying out research on your competitors, partners and customers… but that’s not all.

Company credit reports are also handy when it comes to looking at how other people see your limited company.

It’s a bit like Googling yourself.

Depending on what company credit report you buy, you’ll be able to view an assortment of information directly related to your company. You can then act and improve on any areas that do not show your company in the best light.

Take a look at what information is included in each of our company credit reports.

By Mathew Aitken at MadeSimple – Find Mathew on Google+

The accounts section of your Company Credit Report may seem out of date; in this blog post we look at why.

A limited company does not need to file its first set of accounts until 21 months after incorporation (if accounts are filed any later Companies House will issue a penalty) – these accounts would normally cover from the date of incorporation up until the accounting reference date (this is automatically set as the last day of the month that the company was formed in).

For example, if a company was formed on 10/01/2014, the accounts would be due on 10/10/15 and should cover from 10/01/14 up to 31/01/15. The following accounts are then due 9 months after the accounting reference date.

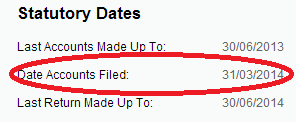

Because of this, when you purchase a Company Credit Report, the accounts may appear out of date, when in fact this is just because accounts are filed to Companies House months in arrears to the period that they are covering. It is also possible that the company has simply not filed a recent set of accounts yet – you can check the date that the last accounts were filed on the “Base Information” page of the report:

If you have any questions about our Company Credit Reports, you may find our dedicated FAQs useful.

This post was by Mathew Aitken at MadeSimple – Find Mathew on Google+

Why use Company Searches Made Simple? Here’s 5 reasons.

To protect yourself if you’re looking to go into business with business partners or suppliers

Doing research on potential partners or suppliers is absolutely vital – especially for vulnerable smaller businesses where one slip-up can be damaging. A company credit report will help you pinpoint problem areas that should cause you concern.

Keep informed with your company’s credit rating

How do others see your business? Stay a step ahead and buy a company credit report to find out.

Monitor your competition

If you set up a company tracker against another company, you’ll be notified whenever said company files something with Companies House; appointments, resignations, annual returns, annual accounts and more.

Combat fraud

Similarly, set up a company tracker against your own company and you’ll be notified if someone is trying to make changes to your company, allowing you to act swiftly in notifying Companies House.

Get copies of lost company documents

Lost your Certificate of Incorporation? Misplaced your Memorandum and Articles? Accidentally shredded your recently filed Annual Return? Don’t worry, we can provide you with copies.

For more information about our services, take a look here: Products & Pricing

This post was by Rachel Simoyan at MadeSimple – Find Rachel on Google+

You’ve nothing to worry about when you buy a Company Searches Made Simple service

It’s as simple as that.

This post was by Mathew Aitken at MadeSimple – Find Mathew on Google+

In this, our latest video post, I explain how company credit reports do not change once they’ve been purchased and how you can set up a company tracker so that you’re notified when changes occur to a company.

This post was by Mathew Aitken at MadeSimple – Find Mathew on Google+

Company credit reports can seem like a complicated business, but they’re well worth thinking about.

Both the businesses you choose to work with and your own company can be affected by credit reports, so having a look at them is a good idea. Here are three reasons why you should be paying attention to company credit reports.

1. You can use them to check out credibility. You will be able to buy and view the credit reports of any companies you are considering working with, for example any potential suppliers, and you can also view credit reports of any possible customers. It’s a really good way of making sure these companies are legitimate and credible – if you see a bad credit report you’ll know not to associate your company with them.

2. Research your competition. Use a company credit report to have a look at how businesses similar to your own are doing, and then you can compare yourself as a result. As the service is completely anonymous you can view all of this information without worrying about being caught out.

3. To see how you are seen by others. It’s great to be able to look at other company’s credit reports, but buying and having access to your own is also a good idea. Looking at your credit report in the same way it will appear to any peers or clients is a good tool to help you understand how appealing your company is to an outside party.

So there you have it: proof that Company Credit Reports are definitely worth having a look at!

Search for your company name now to see what your credit report looks like!

Once purchased, Company Credit Reports are static.

In a word; no. Company credit reports do not change. The reports available on Company Searches Made Simple are correct and up-to-date up to the point that they’re purchased – they are then static.

For example, if you bought a standard credit or fully comprehensive company report now, and a director of that company resigned tomorrow, the report would still state that the director is a current director. However, if you were to buy another report tomorrow, the new report would be updated.

This is the exact reason why we give our company credit reports a one year shelf life (they are then removed from your account), otherwise your account would eventually include reports that are out-of-date.

We can however notify you as and when changes are made to companies via our company tracker service. You then know that an updated version of a company report is available.

See here for more information on our company credit reports and company tracker services.

This post was by Mathew Aitken at MadeSimple – Find Mathew on Google+

Peter; football pundit / company credit report expert

Another Premier League season is over. Sigh. To fill the football void between now and the Champions League final (and then the World Cup!), Peter has decided to give us a Premier League review with a company credit report spin.

Good evening ladies and gentlemen and welcome to this special football/credit report. We’ll be running through a selection of unnamed teams assessing how the last year has gone for them and the effect on their (pretend!) credit scores. You then need to guess what team I’m talking about! Let’s get started…

What team is this?

1. This team’s season started with a bang as a new manager got points on the board when the new accounts were filed. Unfortunately this turned out to be a red herring as the accounts turned up high levels of debt accrued by irresponsible American investors and the manager was left with egg on his face – which would eventually lead to his dismissal. Continue reading

Do we do reports on companies limited by guarantee? Yes we do!

1. Search for the company from our homepage

2. Select the correct company

3. Choose which report you want and proceed to make the purchase (the pricing is the same too)

What information is included in the report? Continue reading